Page 83 - Index

P. 83

02-40 CORPORATE OVERVIEW 41-59 STATUTORY REPORTS 60-147 FINANCIAL STATEMENTS Standalone

Notes

to the Standalone Financial Statements for the year ended 31 March 2022

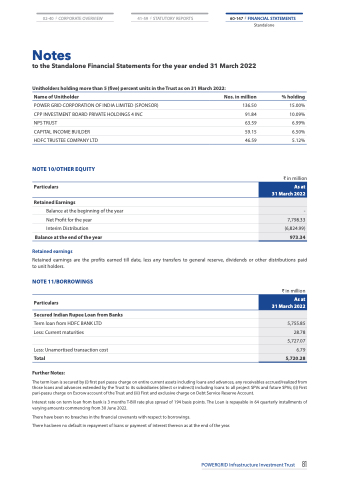

Unitholders holding more than 5 (five) percent units in the Trust as on 31 March 2022:

Name of Unitholder

POWER GRID CORPORATION OF INDIA LIMITED (SPONSOR) CPP INVESTMENT BOARD PRIVATE HOLDINGS 4 INC

NPS TRUST

CAPITAL INCOME BUILDER

HDFC TRUSTEE COMPANY LTD

NOTE 10/OTHER EQUITY

Particulars

Retained Earnings

Balance at the beginning of the year Net Profit for the year

Interim Distribution

Balance at the end of the year

Retained earnings

Nos. in million

136.50

91.84

63.59

59.15

46.59

% holding

15.00%

10.09%

6.99%

6.50%

5.12%

₹ in million

As at 31 March 2022

-

7,798.33

(6,824.99)

973.34

Retained earnings are the profits earned till date, less any transfers to general reserve, dividends or other distributions paid to unit holders.

NOTE 11/BORROWINGS

Particulars

Secured Indian Rupee Loan from Banks

Term loan from HDFC BANK LTD Less: Current maturities

Less: Unamortised transaction cost

Total

Further Notes:

₹ in million

As at 31 March 2022

5,755.85

28.78

5,727.07

6.79

5,720.28

The term loan is secured by (i) first pari passu charge on entire current assets including loans and advances, any receivables accrued/realized from those loans and advances extended by the Trust to its subsidiaries (direct or indirect) including loans to all project SPVs and future SPVs; (ii) First pari-passu charge on Escrow account of the Trust and (iii) First and exclusive charge on Debt Service Reserve Account.

Interest rate on term loan from bank is 3 months T-Bill rate plus spread of 194 basis points. The Loan is repayable in 64 quarterly installments of varying amounts commencing from 30 June 2022.

There have been no breaches in the financial covenants with respect to borrowings.

There has been no default in repayment of loans or payment of interest thereon as at the end of the year.

POWERGRID Infrastructure Investment Trust 81