Page 82 - Index

P. 82

Notes

to the Standalone Financial Statements for the year ended 31 March 2022

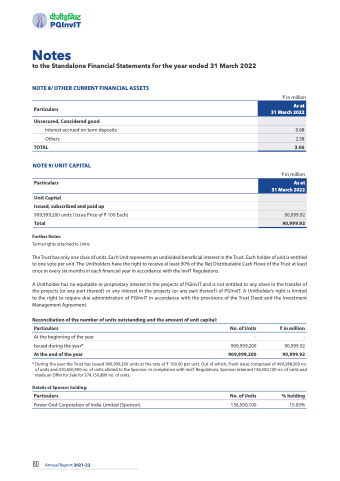

NOTE 8/ OTHER CURRENT FINANCIAL ASSETS

Particulars

Unsecured, Considered good

Interest accrued on term deposits

Others

TOTAL

NOTE 9/ UNIT CAPITAL

Particulars

Unit Capital

Issued, subscribed and paid up 909,999,200 units ( Issue Price of ₹ 100 Each) Total

Further Notes:

Terms/rights attached to Units

₹ in million

As at 31 March 2022

0.68

2.38

3.06

₹ in million

As at 31 March 2022

90,999.92

90,999.92

The Trust has only one class of units. Each Unit represents an undivided beneficial interest in the Trust. Each holder of unit is entitled to one vote per unit. The Unitholders have the right to receive at least 90% of the Net Distributable Cash Flows of the Trust at least once in every six months in each financial year in accordance with the InvIT Regulations.

A Unitholder has no equitable or proprietary interest in the projects of PGInvIT and is not entitled to any share in the transfer of the projects (or any part thereof) or any interest in the projects (or any part thereof) of PGInvIT. A Unitholder’s right is limited to the right to require due administration of PGInvIT in accordance with the provisions of the Trust Deed and the Investment Management Agreement.

Reconciliation of the number of units outstanding and the amount of unit capital:

Particulars

At the beginning of the year Issued during the year*

At the end of the year

No. of Units

-

909,999,200

909,999,200

₹ in million

-

90,999.92

90,999.92

* During the year the Trust has issued 909,999,200 units at the rate of ₹ 100.00 per unit. Out of which, Fresh issue comprised of 499,348,300 no. of units and 410,650,900 no. of units alloted to the Sponsor. In compliance with InvIT Regulations, Sponsor retained 136,500,100 no. of units and made an Offer for Sale for 274,150,800 no. of units.

Details of Sponsor holding:

Particulars No. of Units % holding

Power Grid Corporation of India Limited (Sponsor) 136,500,100 15.00%

80 Annual Report 2021-22