Page 71 - Index

P. 71

02-40 CORPORATE OVERVIEW 41-59 STATUTORY REPORTS 60-147 FINANCIAL STATEMENTS Standalone

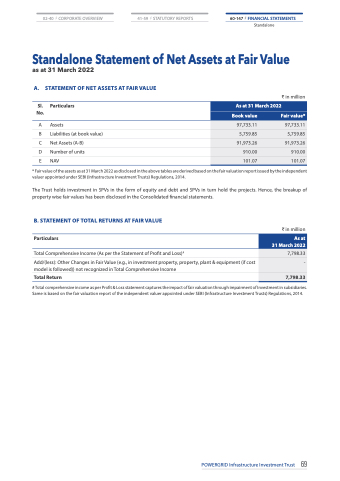

Standalone Statement of Net Assets at Fair Value

as at 31 March 2022

A.

Sl. No.

A B C D E

STATEMENT OF NET ASSETS AT FAIR VALUE

Particulars

Assets

Liabilities (at book value) Net Assets (A-B)

Number of units

NAV

₹ in million

As at 31 March 2022

Book value

Fair value*

97,733.11

97,733.11

5,759.85

5,759.85

91,973.26

91,973.26

910.00

910.00

101.07

101.07

* Fair value of the assets as at 31 March 2022 as disclosed in the above tables are derived based on the fair valuation report issued by the independent valuer appointed under SEBI (Infrastructure Investment Trusts) Regulations, 2014.

The Trust holds investment in SPVs in the form of equity and debt and SPVs in turn hold the projects. Hence, the breakup of property wise fair values has been disclosed in the Consolidated financial statements.

B. STATEMENT OF TOTAL RETURNS AT FAIR VALUE

Particulars

Total Comprehensive Income (As per the Statement of Profit and Loss)#

Add/(less): Other Changes in Fair Value (e.g., in investment property, property, plant & equipment (if cost model is followed)) not recognized in Total Comprehensive Income

Total Return

₹ in million

As at 31 March 2022

7,798.33

-

7,798.33

# Total comprehensive income as per Profit & Loss statement captures the impact of fair valuation through impairment of Investment in subsidiaries. Same is based on the fair valuation report of the independent valuer appointed under SEBI (Infrastructure Investment Trusts) Regulations, 2014.

POWERGRID Infrastructure Investment Trust 69