Page 59 - Index

P. 59

02-40

CORPORATE OVERVIEW

41-59 STATUTORY REPORTS 60-147 FINANCIAL STATEMENTS Report on Corporate Governance

NSE

No. of units traded

2,95,66,611

2,01,24,522

1,28,11,092

1,33,04,051

1,66,65,796

BSE

Price (₹) No. of units (High/ traded

Low)

135.00/ 8,70,438 118.00

122.37/ 9,94,477 115.15

136.30/ 6,54,348 120.20

133.45/ 6,80,452 126/00

137.14/ 8,99,458 120.80

7.

S. No.

1.

2. 3.

4. 5.

6. 7.

8. 9.

10.

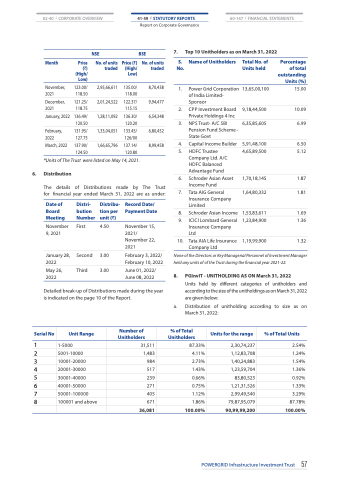

Top 10 Unitholders as on March 31, 2022

Month

November, 2021

December, 2021

January, 2022

February, 2022

March, 2022

Price (₹) (High/ Low)

123.00/ 118.50

121.25/ 118.75

136.49/ 120.50

131.95/ 127.75

137.90/ 124.50

Name of Unitholders

Power Grid Corporation of India Limited- Sponsor

CPP Investment Board Private Holdings 4 Inc

NPS Trust- A/C SBI Pension Fund Scheme - State Govt

Capital Income Builder

HDFC Trustee Company Ltd. A/C HDFC Balanced Advantage Fund

Schroder Asian Asset Income Fund

Tata AIG General Insurance Company Limited

Schroder Asian Income

ICICI Lombard General Insurance Company Ltd

Tata AIA Life Insurance Company Ltd

Total No. of Units held

Percentage of total outstanding Units (%)

*Units of The Trust were listed on May 14, 2021.

6. Distribution

The details of Distributions made by The Trust for financial year ended March 31, 2022 are as under:

13,65,00,100 15.00

9,18,44,500 10.09

6,35,85,605 6.99

5,91,48,100 6.50

4,65,89,500 5.12

1,70,18,145 1.87

1,64,80,332 1.81

1,53,83,611 1.69

1,23,84,900 1.36

1,19,99,900 1.32

Date of Board Meeting

November 9, 2021

January 28, 2022

May 26, 2022

Distri- bution Number

First

Second

Third

Distribu- tion per unit (₹)

4.50

3.00

3.00

Record Date/ Payment Date

November 15, 2021/ November 22, 2021

February 3, 2022/ February 10, 2022

June 01, 2022/ June 08, 2022

None of the Directors or Key Managerial Personnel of Investment Manager held any units of of the Trust during the financial year 2021-22.

8. PGInvIT - UNITHOLDING AS ON March 31, 2022

Units held by different categories of unitholders and according to the size of the unitholdings as on March 31, 2022 are given below:

a. Distribution of unitholding according to size as on March 31, 2022:

Detailed break-up of Distributions made during the year is indicated on the page 10 of the Report.

Serial No

1

2

3

4

5

6

7

8

Unit Range Number of Unitholders

1-5000 31,511

5001-10000 1,483

% of Total Unitholders

87.33%

4.11%

2.73%

1.43%

0.66%

0.75%

1.12%

Units for the range

2,30,74,237

1,12,83,708

1,40,24,883

1,23,59,704

83,80,523

1,21,31,526

2,99,49,540

% of Total Units

2.54%

1.24%

1.54%

1.36%

0.92%

1.33%

3.29%

87.78%

100.00%

10001-20000

20001-30000

30001-40000

40001-50000

50001-100000

100001 and above

984

517

239

271

405

671

36,081

1.86% 79,87,95,079

100.00% 90,99,99,200

POWERGRID Infrastructure Investment Trust 57