Page 15 - Index

P. 15

02-40 CORPORATE OVERVIEW 41-59 STATUTORY REPORTS 60-147 FINANCIAL STATEMENTS

About PGInvIT

Profile

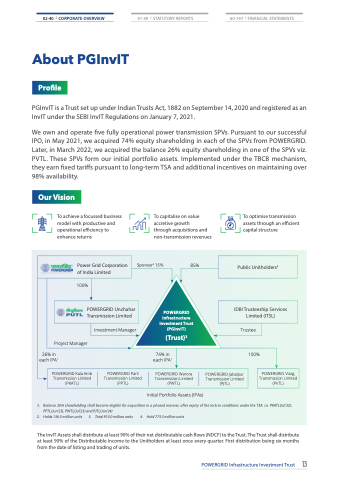

PGInvIT is a Trust set up under Indian Trusts Act, 1882 on September 14, 2020 and registered as an InvIT under the SEBI InvIT Regulations on January 7, 2021.

We own and operate five fully operational power transmission SPVs. Pursuant to our successful IPO, in May 2021, we acquired 74% equity shareholding in each of the SPVs from POWERGRID. Later, in March 2022, we acquired the balance 26% equity shareholding in one of the SPVs viz. PVTL. These SPVs form our initial portfolio assets. Implemented under the TBCB mechanism, they earn fixed tariffs pursuant to long-term TSA and additional incentives on maintaining over 98% availability.

Our Vision

To achieve a focussed business model with productive and operational efficiency to enhance returns

To capitalise on value accretive growth

through acquisitions and non-transmission revenues

To optimise transmission assets through an efficient capital structure

Power Grid Corporation of India Limited

Public Unitholders4

100%

Project Manager

26% in each IPA1

Investment Manager

Sponsor2 15% 85%

POWERGRID Infrastructure Investment Trust (PGInvIT)

(Trust)3

Trustee

POWERGRID Unchahar Transmission Limited

IDBI Trusteeship Services Limited (ITSL)

74% in 100% each IPA1

Initial Portfolio Assets (IPAs)

POWERGRID Kala Amb Transmission Limited (PKATL)

POWERGRID Parli Transmission Limited (PPTL)

POWERGRID Warora Transmission Limited (PWTL)

POWERGRID Jabalpur Transmission Limited (PJTL)

1. Balance 26% shareholding shall become eligible for acquisition in a phased manner, after expiry of the lock-in conditions under the TSA. i.e. PKATL(Jul’22); PPTL(Jun’23), PWTL(Jul’23) and PJTL(Jan’24)

2. Holds 136.5 million units 3. Total 910.0 million units 4. Hold 773.5 million units

POWERGRID Vizag Transmission Limited (PVTL)

The InvIT Assets shall distribute at least 90% of their net distributable cash flows (NDCF) to the Trust. The Trust shall distribute at least 90% of the Distributable Income to the Unitholders at least once every quarter. First distribution being six months from the date of listing and trading of units.

POWERGRID Infrastructure Investment Trust 13