Page 147 - Index

P. 147

02-40 CORPORATE OVERVIEW 41-59 STATUTORY REPORTS 60-147 FINANCIAL STATEMENTS Consolidated

Notes

to the Consolidated Financial Statements for the year ended 31 March 2022

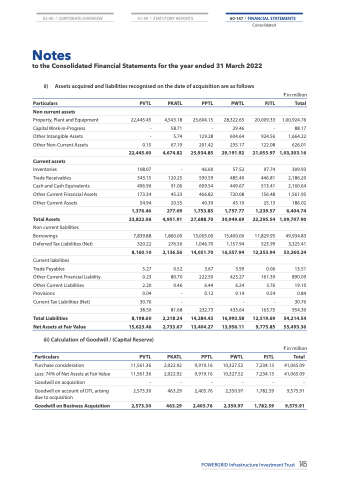

ii) Assets acquired and liabilities recognised on the date of acquisition are as follows

Particulars PVTL

Non current assets

Property, Plant and Equipment 22,445.45

Capital Work-in-Progress -

Other Intangible Assets -

Other Non-Current Assets 0.15

22,445.60

Current assets

Inventories 108.07

PKATL

4,543.18

58.71

5.74

67.19

4,674.82

-

120.25

91.06

45.23

20.55

277.09

4,951.91

1,860.00

PPTL

25,604.15

-

129.28

201.42

25,934.85

46.60

590.59

609.54

466.82

40.30

1,753.85

27,688.70

13,005.00

1,046.70

14,051.70

3.67

222.50

6.44

0.12

-

232.73

14,284.43

13,404.27

PPTL

9,919.16

9,919.16

-

2,405.76

2,405.76

PWTL

28,322.65

29.46

604.64

235.17

29,191.92

57.52

485.40

449.67

720.08

45.10

1,757.77

30,949.69

15,400.00

1,157.94

16,557.94

3.99

425.27

6.24

0.14

-

435.64

16,993.58

13,956.11

PWTL

10,327.52

10,327.52

-

2,350.97

2,350.97

PJTL

20,009.33

-

924.56

122.08

21,055.97

97.74

446.81

513.41

156.48

25.13

1,239.57

22,295.54

11,829.95

523.99

12,353.94

0.06

161.39

3.76

0.54

-

165.75

12,519.69

9,775.85

PJTL

7,234.13

7,234.13

-

1,782.59

1,782.59

₹ in million

Total

1,00,924.76

88.17

1,664.22

626.01

1,03,303.16

309.93

2,186.20

2,160.64

1,561.95

186.02

6,404.74

1,09,707.90

49,934.83

3,325.41

53,260.24

13.51

890.09

19.10

0.84

30.76

954.30

54,214.54

55,493.36

₹ in million

Total

41,065.09

41,065.09

-

9,575.91

9,575.91

Trade Receivables

Cash and Cash Equivalents

Other Current Financial Assets

Other Current Assets

Total Assets

Non current liabilities

543.15

496.96

173.34

54.94

1,376.46

23,822.06

Borrowings 7,839.88

Deferred Tax Liabilities (Net)

Current liabilities

Trade Payables

Other Current Financial Liability

Other Current Liabilities

320.22 276.56

8,160.10 2,136.56

5.27 0.52

0.23 80.70

2.20 0.46

Provisions 0.04

-

-

81.68

2,218.24

2,733.67

PKATL

2,022.92

2,022.92

-

463.29

463.29

Current Tax Liabilities (Net)

Total Liabilities

Net Assets at Fair Value

30.76

38.50

8,198.60

15,623.46

iii) Calculation of Goodwill / (Capital Reserve)

Particulars PVTL

Purchase consideration

Less: 74% of Net Assets at Fair Value

Goodwill on acquisition

Goodwill on account of DTL arising due to acquisition

Goodwill on Business Acquisition

11,561.36

11,561.36

-

2,573.30

2,573.30

POWERGRID Infrastructure Investment Trust 145