Page 132 - Index

P. 132

Notes

to the Consolidated Financial Statements for the year ended 31 March 2022

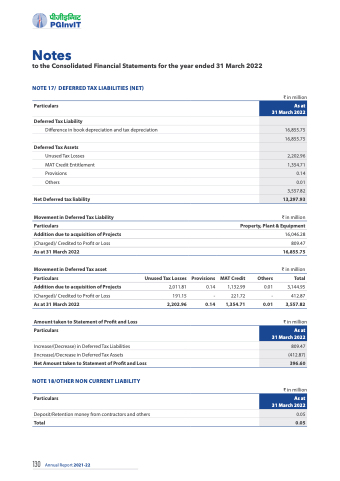

NOTE 17/ DEFERRED TAX LIABILITIES (NET)

Particulars

Deferred Tax Liability

Difference in book depreciation and tax depreciation

₹ in million

As at 31 March 2022

16,855.75

16,855.75

2,202.96

1,354.71

0.14

0.01

3,557.82

13,297.93

Deferred Tax Assets

Unused Tax Losses MAT Credit Entitlement Provisions

Others

Net Deferred tax liability

Movement in Deferred Tax Liability

Particulars

Addition due to acquisition of Projects (Charged)/ Credited to Profit or Loss

As at 31 March 2022

Movement in Deferred Tax asset

Particulars

Addition due to acquisition of Projects (Charged)/ Credited to Profit or Loss

As at 31 March 2022

Amount taken to Statement of Profit and Loss Particulars

Increase/(Decrease) in Deferred Tax Liabilities (Increase)/Decrease in Deferred Tax Assets

Net Amount taken to Statement of Profit and Loss

NOTE 18/OTHER NON CURRENT LIABILITY

Particulars

Deposit/Retention money from contractors and others

Total

₹ in million

Property, Plant & Equipment

Unused Tax Losses

2,011.81

191.15

2,202.96

Provisions

0.14

-

0.14

MAT Credit

1,132.99

221.72

1,354.71

Others

0.01

-

0.01

16,046.28

809.47

16,855.75

₹ in million

Total

3,144.95

412.87

3,557.82

₹ in million

₹ in million

As at 31 March 2022

809.47

(412.87)

396.60

As at 31 March 2022

0.05

0.05

130 Annual Report 2021-22