Page 128 - Index

P. 128

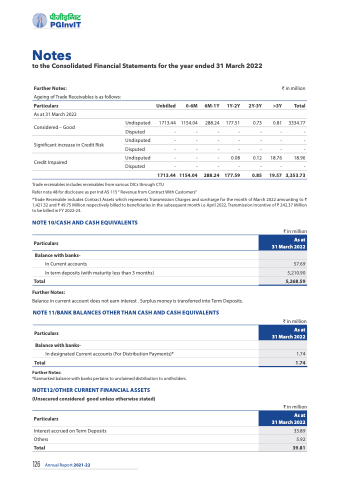

Notes

to the Consolidated Financial Statements for the year ended 31 March 2022

Further Notes:

Ageing of Trade Receivables is as follows:

Particulars

As at 31 March 2022

Considered – Good

Significant increase in Credit Risk Credit Impaired

Undisputed

Disputed

Undisputed

Disputed

Undisputed

Disputed

Unbilled 0-6M

1713.44 1154.04

6M-1Y

288.24

1Y-2Y 2Y-3Y

177.51 0.73

₹ in million

>3Y Total

0.81 3334.77

-------

- - - - - - -

-------

- - - 0.08 0.12 18.76 18.96

-------

1713.44 1154.04 288.24 177.59 0.85 19.57 3,353.73

Trade receivables includes receivables from various DICs through CTU

Refer note 48 for disclosure as per Ind AS 115 “ Revenue from Contract With Customers”

*Trade Receivable includes Contract Assets which represents Transmission Charges and surcharge for the month of March 2022 amounting to ₹ 1,421.32 and ₹ 49.75 Million respectively billed to beneficiaries in the subsequent month i.e April 2022, Transmission Incentive of ₹ 242.37 Million to be billed in FY 2022-23.

NOTE 10/CASH AND CASH EQUIVALENTS

Particulars

Balance with banks-

In Current accounts

In term deposits (with maturity less than 3 months)

Total

Further Notes:

Balance in current account does not earn interest . Surplus money is transferred into Term Deposits.

NOTE 11/BANK BALANCES OTHER THAN CASH AND CASH EQUIVALENTS

Particulars

Balance with banks-

In designated Current accounts (For Distribution Payments)*

Total

Further Notes:

*Earmarked balance with banks pertains to unclaimed distribution to unitholders.

NOTE12/OTHER CURRENT FINANCIAL ASSETS

(Unsecured considered good unless otherwise stated) Particulars

Interest accrued on Term Deposits Others

Total

₹ in million

As at 31 March 2022

57.69

5,210.90

5,268.59

₹ in million

As at 31 March 2022

1.74

1.74

₹ in million

As at 31 March 2022

33.89

5.92

39.81

126 Annual Report 2021-22