Page 12 - Index

P. 12

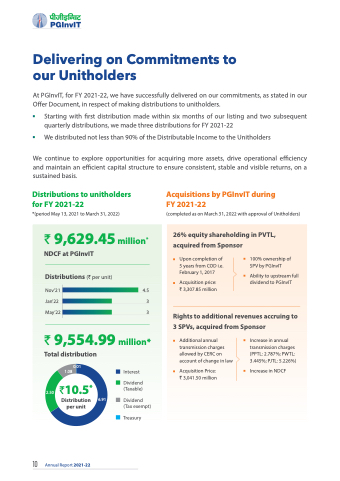

Delivering on Commitments to our Unitholders

At PGInvIT, for FY 2021-22, we have successfully delivered on our commitments, as stated in our Offer Document, in respect of making distributions to unitholders.

Starting with first distribution made within six months of our listing and two subsequent quarterly distributions, we made three distributions for FY 2021-22

We distributed not less than 90% of the Distributable Income to the Unitholders

We continue to explore opportunities for acquiring more assets, drive operational efficiency and maintain an efficient capital structure to ensure consistent, stable and visible returns, on a sustained basis.

Distributions to unitholders for FY 2021-22

*(period May 13, 2021 to March 31, 2022)

` 9,629.45 million* NDCF at PGInvIT

Distributions (` per unit)

Nov’21 4.5 Jan’22 3 May’22 3

` 9,554.99 million* Total distribution

Acquisitions by PGInvIT during FY 2021-22

(completed as on March 31, 2022 with approval of Unitholders)

26% equity shareholding in PVTL, acquired from Sponsor

Upon completion of 5 years from COD i.e. February 1, 2017

Acquisition price: ` 3,307.85 million

100% ownership of SPV by PGInvIT

Ability to upstream full dividend to PGInvIT

Rights to additional revenues accruing to 3 SPVs, acquired from Sponsor

1.08 0.01

2.50 `10.5*

Distribution 6.91 per unit

Interest

Dividend ( Taxable)

Dividend (Tax exempt)

Treasury

Additional annual transmission charges allowed by CERC on account of change in law

Acquisition Price: ` 3,041.50 million

Increase in annual transmission charges (PPTL: 2.787%; PWTL: 3.445%; PJTL: 5.226%)

Increase in NDCF

10

Annual Report 2021-22