Page 105 - Index

P. 105

02-40 CORPORATE OVERVIEW 41-59 STATUTORY REPORTS 60-147 FINANCIAL STATEMENTS Consolidated

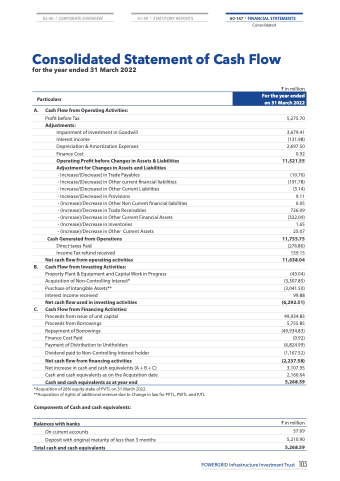

Consolidated Statement of Cash Flow

for the year ended 31 March 2022

Particulars

A. Cash Flow from Operating Activities:

Profit before Tax

Adjustments:

Impairment of investment in Goodwill Interest income

Depreciation & Amortization Expenses Finance Cost

Operating Profit before Changes in Assets & Liabilities Adjustment for Changes in Assets and Liabilities

- Increase/(Decrease) in Trade Payables

- Increase/(Decrease) in Other current financial liabilities

- Increase/(Decrease) in Other Current Liabilities

- Increase/(Decrease) in Provisions

- (Increase)/Decrease in Other Non Current financial liabilities - (Increase)/Decrease in Trade Receivables

- (Increase)/Decrease in Other Current Financial Assets

- (Increase)/Decrease in Inventories

- (Increase)/Decrease in Other Current Assets

Cash Generated from Operations

Direct taxes Paid

Income Tax refund received

Net cash flow from operating activities

B. Cash Flow from Investing Activities:

Property Plant & Equipment and Capital Work in Progress Acquisition of Non-Controlling Interest*

Purchase of Intangible Assets**

Interest income received

Net cash flow used in investing activities

C. Cash Flow from Financing Activities:

Proceeds from issue of unit capital Proceeds from Borrowings Repayment of Borrowings Finance Cost Paid

Payment of Distribution to Unitholders

Dividend paid to Non-Controlling Interest holder Net cash flow from financing activities

Net increase in cash and cash equivalents (A + B + C) Cash and cash equivalents as on the Acquisition date

Cash and cash equivalents as at year end

*Acquisition of 26% equity stake of PVTL on 31 March 2022.

**Acquisition of rights of additional revenue due to Change in law for PPTL, PWTL and PJTL

Components of Cash and cash equivalents:

Balances with banks

On current accounts

Deposit with original maturity of less than 3 months

Total cash and cash equivalents

₹ in million

5,275.70

3,679.41 (131.98) 2,697.50 0.92 11,521.55

(10.76) (191.78) (3.14) 9.11 0.05 726.09 (322.09) 1.65 25.07 11,755.75 (276.86) 159.15 11,638.04

(43.04) (3,307.85) (3,041.50) 99.88 (6,292.51)

49,934.83 5,755.85 (49,934.83) (0.92) (6,824.99) (1,167.52) (2,237.58) 3,107.95 2,160.64 5,268.59

₹ in million 57.69 5,210.90 5,268.59

POWERGRID Infrastructure Investment Trust 103

For the year ended on 31 March 2022